Otoplenie-Blog.com.ua > Bookkeeping > Accounts Payable Turnover: Definition, Formula & Calculator

Accounts Payable Turnover: Definition, Formula & Calculator

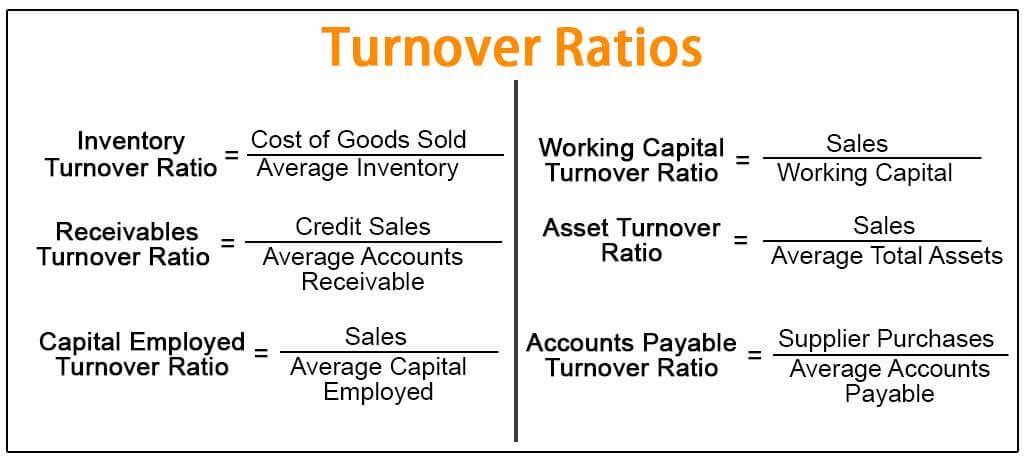

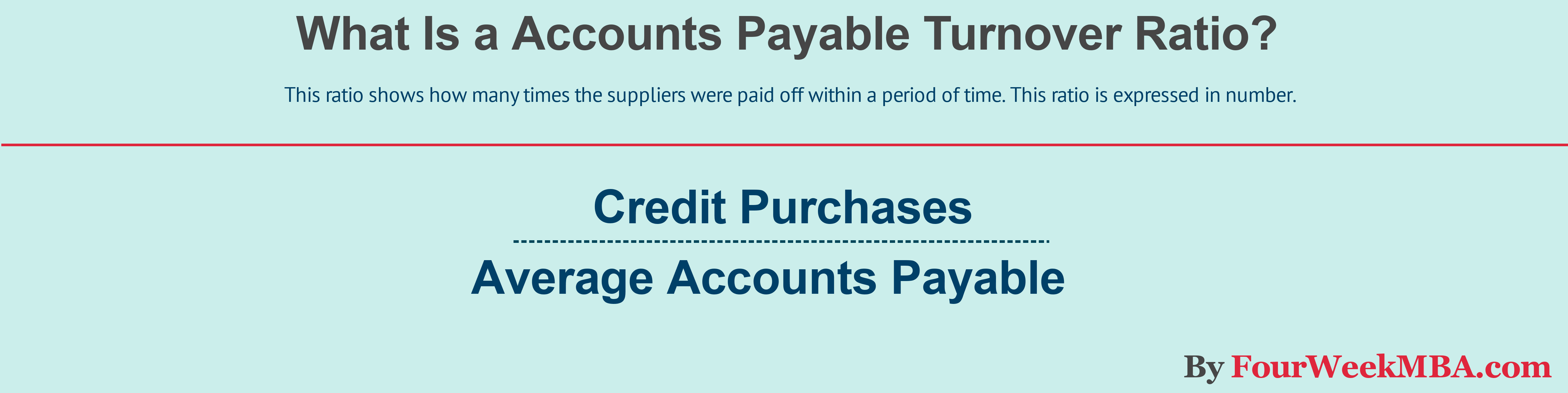

Entering incorrect information, such as incorrect invoice amounts or payment dates, can lead to delayed payments and negatively impact the ratio. It is important to have a system in place to ensure accurate data entry and to regularly review and reconcile accounts payable records to avoid errors. Simply, the AP turnover ratio gives a measure of the rate suppliers/vendors are paid off. DPO counts the average number of days it takes a company to pay off its outstanding supplier invoices for purchases made on credit. The total supplier purchase amount should ideally only consist of credit purchases, but the gross purchases from suppliers can be used if the full payment details are not readily available. In other words, your business pays its accounts payable at a rate of 1.46 times per year.

Limitations of AP Turnover Ratio

Accounts payable turnover ratio is a measure of your business’s liquidity, or ability to pay its debts. The higher the accounts payable turnover ratio, the quicker your business pays its debts. This article will deconstruct the accounts payable turnover ratio, how to calculate it — and what it means for your business. When the figure for the AP turnover ratio increases, the company is paying off suppliers at a faster rate than in previous periods. It means the company has plenty of cash available to pay off its short-term debts in a timely manner.

Accounts Payable Turnover Ratio: What It Is, How To Calculate and Improve It

- If it’s not automated, you can create either standard or custom reports on demand.

- More cash allows you to pay off bills, and the faster you receive cash, the fast you can make payments.

- In corporate finance, you can add immense value by monitoring and analyzing the accounts payable turnover ratio.

- Accounts receivable turnover ratio shows how effective a company is at collecting money owed by clients.

However, an increasing ratio over a long period of time could also indicate that the company is not reinvesting money back into its business. This could result in a lower growth rate and lower earnings for the company in the long term. A transactions listing is a compiled list of all debits and credits in your general ledger (GL) for a specific period. Therefore, your AP transactions listing lists only debits and credits that hit your accounts payable account. This report can be helpful if you need to see individual journal entries in your GL accounts. This includes disbursements made via handwritten checks, electronic payments, bank transfers, money transfers, credit card payments, etc.

What the AP turnover ratio can tell you

If the keep ghosts off the payroll decreases over time, it indicates that a company is taking longer to pay off its debts. Suppose the company in question has not renegotiated payment terms with its suppliers. In that case, a decreasing ratio could show cash flow problems or financial distress. The accounts payable turnover ratio is a financial metric that measures how efficiently a company pays back its suppliers. It provides important insights into the frequency or rate with which a company settles its accounts payable during a particular period, usually a year. It is important to note that a high accounts payable turnover ratio may indicate that a company is paying its suppliers too quickly, which could lead to cash flow problems.

Automated systems can provide real-time insights into payable and spending patterns, enabling more strategic decision-making. Improved cash flow management inherently affects the AP turnover ratio by ensuring funds are available for timely payments. To optimize the AP turnover ratio, companies can leverage technology and AP automation to improve the efficiency of their accounts payable processes.

Formula and Calculation of the AP Turnover Ratio

Since the accounts payable turnover ratio is used to measure short-term liquidity, in most cases, the higher the ratio, the better the financial condition the company is in. AP aging comes into play here, too, since it digs deeper into accounts payable and how any outstanding debt could affect future financials. An AP aging report allows you to organize the total amount due into 30-day “buckets”, so you can track payments that are due and payments that are overdue. If your AP turnover isn’t high enough, you’ll see how that lower ratio affects your ongoing debt.

Payment terms can vary from supplier to supplier and can have a significant impact on the ratio. For example, if a company negotiates longer payment terms with its suppliers, it may have a lower turnover ratio as it takes longer to pay off its accounts payable. On the other hand, if a company negotiates shorter payment terms, it may have a higher turnover ratio as it pays off its accounts payable more quickly. To calculate the average accounts payable outstanding, you can add the beginning and ending accounts payable balances and divide the sum by two. Accounts receivable turnover ratio is another accounting measure used to assess financial health. Accounts receivable (AR) turnover ratio simply measures the effectiveness in collecting money from customers.

It allows you to keep track of all of your income and expenses for your business. You can also run several reports that will help you not only calculate your A/P and A/R turnover ratios but also analyze cash flow and profitability. Calculating the accounts payable ratio consists of dividing a company’s total supplier credit purchases by its average accounts payable balance.

This report serves as a reminder to use those credits and can even remind you to prioritize certain vendors to make use of your available credits. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. Add the beginning and ending balance of A/P then divide it by 2 to get the average. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

A vendor discount report lists all the different discounts you receive (or could be eligible to receive) from suppliers and vendors. This information can be helpful when making payment decisions and reviewing pricing. The 63 Days payables turnover calculation in this article is reasonable considering general creditor terms. It would be best if you made more comparisons to be sure it’s the right number for your company.